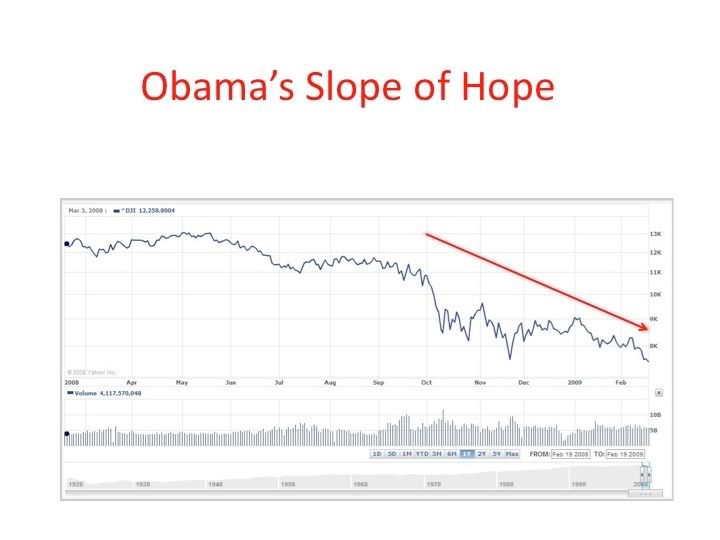

Re: Despite high hopes, the Obama economy keeps hitting lower and lower lows

Bear Market's Bite Could Go Deeper

Dow at 6-Year Low, but Analysts Say More Pain Lies Ahead

<table style="float: right; clear: both;" id="content_column_table" width="238" cellpadding="0" cellspacing="0"> <tbody><tr><td width="10">

</td><td width="228"> <script language="javascript"> if (document.images) { var tab0On = "http://chart.bigcharts.com/custom/wpost/tab-dow.gifquote"; var tab1On = "http://chart.bigcharts.com/custom/wpost/tab-spx.gifquote"; var tab2On = "http://chart.bigcharts.com/custom/wpost/tab-nas.gifquote"; function reFresh(whichmap,myImg){ if (document.images) document.images[whichmap].src = myImg +'?rnd='+Math.random(); } } </script> <map name="tabs"> <area shape="rect" coords="2,8,75,25" onmouseover="reFresh('mktImg',tab0On);" href="javascript%3Cb%3E%3C/b%3E:;" alt="DJIA" title="DJIA"> <area shape="rect" coords="78,8,151,25" onmouseover="reFresh('mktImg',tab1On);" href="javascript%3Cb%3E%3C/b%3E:;" alt="S&P 500" title="S&P 500"> <area shape="rect" coords="154,8,226,25" onmouseover="reFresh('mktImg',tab2On);" href="javascript%3Cb%3E%3C/b%3E:;" alt="NASDAQ" title="NASDAQ"> </map>

<table style="position: relative; left: 0px; top: -1px;" width="228" border="0" cellpadding="0" cellspacing="0"> <tbody><tr> <td width="1" bgcolor="#cccccc"><spacer type="block" width="1"></td> <td colspan="3" bgcolor="#ffffff" height="1"><spacer type="block" height="1"></td> <td width="1" bgcolor="#cccccc"><spacer type="block" width="1"></td> </tr> <tr> <td width="1" bgcolor="#cccccc"><spacer type="block" width="1"></td> <td width="5" bgcolor="#ffffff"><spacer type="block" width="5"></td> <td valign="top" width="215" align="center"> <!--LINKS TABLE--> <table width="215" border="0" cellpadding="0" cellspacing="0"> <tbody><tr> <td height="7"><spacer type="block" height="7"></td> </tr> <tr> <td bgcolor="#ffffff" height="1"><spacer type="block" height="1"></td> </tr> <tr> <td height="4"><spacer type="block" height="4"></td> </tr> <tr> <td valign="top" align="left">

? Market Indices ? Most Actives

? Winners/Losers ? Upgrades/Downgrades

? Currencies ? Economic Calendar

? Earnings Calendar ? Your Portfolio

? Commodities ? Treasuries

</td><td>

</td></tr> <tr> <td height="4"><spacer type="block" height="4"></td> </tr> </tbody></table> <!--ADVERTISEMENT TABLE--> <!--<table width="215" cellpadding="0" cellspacing="0" border="0"> <tr> <td height="7"><spacer type="block" height="7"></td> </tr> <tr> <td bgcolor="#CD9B34" height="1"><spacer type="block" height="1"></td> </tr> <tr> <td height="4"><spacer type="block" height="4"></td> </tr> <tr> <td valign="top" align="center">

<td> </tr> <tr> <td height="12"><spacer type="block" height="12"></td> </tr> </table>--></td> <td width="6" bgcolor="#ffffff"><spacer type="block" width="6"></td> <td width="1" bgcolor="#cccccc"><spacer type="block" width="1"></td> </tr> <tr> <td colspan="5" bgcolor="#cccccc" height="1"><spacer type="block" height="1"></td> </tr> </tbody></table> <script src="http://media3.washingtonpost.com/wp-srv/article/js/storyPageTools.js"></script>

TOOLBOX

</td></tr></tbody></table>

By Tomoeh Murakami Tse and Alejandro Lazo

Washington Post Staff Writers

Saturday, February 21, 2009; Page D01

NEW YORK, Feb. 20 -- With the

Dow Jones industrial average plunging past its lowest point since the financial crisis began, panicked investors are asking: How much uglier can it get?

This Story

<script> <!-- var rn = ( Math.round( Math.random()*10000000000 ) ); document.write('<s\cript src="http://www.washingtonpost.com/wp-dyn/content/article/2009/02/20/AR2009022001330_StoryJs.js?'+rn+'"></s\cript>') ; // </script>Many market analysts and technicians armed with reams of historical data say that even though the Dow has given back all its gains -- and more -- from the five-year bull market that ended in 2007, it is unlikely the market has hit bottom.

Mark Arbeter, chief technical strategist at Standard & Poor's Equity Research, said the current market environment is showing few of the signs that have characterized previous lows -- high price volatility, high volumes of trading and even higher levels of fear.

"Bear market bottoms tend to be violent affairs," he said. "You sell hard, you rally hard, you go down hard and then you're off to the races. And that's not what were seeing right now. Until this week, the market was really drifting sideways."

And for all the jitteriness out there, Arbeter added, the options market, where investors trade contracts that bet on the future direction of the stock market, is not showing the fear that signals that true capitulation has arrived. Many market participants think capitulation -- when investors take their losses and get out of the market altogether -- must precede a major market recovery.

"We have not reached high enough levels of fear in the options market to suggest that this test of the lows is going to be successful," Arbeter said.

<script> if ( show_doubleclick_ad && ( adTemplate & INLINE_ARTICLE_AD ) == INLINE_ARTICLE_AD && inlineAdGraf ) { placeAd('ARTICLE',commercialNode,20,'inline=y;',true) ; }*</script> <script language="javascript"> <!-- if ( show_doubleclick_ad && ( adTemplate & INLINE_ARTICLE_AD ) == INLINE_ARTICLE_AD && inlineAdGraf ) { document.write('

') ; } // --> </script>The Dow, made up of 30 blue-chips stocks, closed Friday at 7365.67, down 6.2 percent for the week. On Thursday, it fell below the previous bear-market low reached Nov. 20 to hit its lowest level in six years. On Friday, it plunged further as investors worried that banks would be nationalized. The market recovered some of its losses after the Obama administration said it preferred to keep major U.S. financial firms in private hands.

Bank of America and

Citigroup, which have each taken $45 billion in government funds and which investors most fear may be subject to a government takeover, are components of the Dow. They were down 32 and 44 percent for the week, respectively.

The Standard & Poor's 500-stock index, a broader market measure, fell 6.9 percent for the week to close at 770.05. The tech-heavy Nasdaq composite index dropped 6.1 percent, to 1441.23. Both indices have not yet tested their bear-market lows reached on Nov. 20.

Investors flocked to safer havens, including Treasury securities and gold. Prices on the benchmark 10-year Treasury note jumped, sending its yield down to 2.79 percent, from 2.86 percent Thursday. Gold leaped above $1,000, settling at $1,001.80 an ounce on the New York Mercantile Exchange.

Friday's drop in stocks came as the government announced that consumer prices rose 0.3 percent in January when compared with the prior month. Prices remained flat when compared with the same period one year ago -- the first instance since 1955 in which U.S. prices have not increased on a yearly basis.

With more grim economic news expected in the weeks and months ahead, investors are waiting for more clarity on a bank rescue plan from the government. Two weeks ago, markets plunged on a perceived lack of detail in the plan, announced by Treasury Secretary Timothy F. Geithner.

"Trading in general has been pretty thin," said Bart Barnett, head of equity trading at Morgan Keegan. "There are a lot of nervous folks out there, waiting to see how low this market can go . . . When people aren't convinced one way or the other, markets just drift down."

Asked if the new low for the Dow could be a market bottom, Barnett said, "There's an old saying, 'today's lows will be tomorrow's highs.' "

:hangt