Re: NIA Warns Massive Inflation Could Hit the U.S.

Rampant Inflation In 2011? The Monetary Base Is Exploding, Commodity Prices Are Skyrocketing And The Fed Wants To Print Lots More Money

Are you ready for rampant inflation? Well, unfortunately it looks like it might be headed our way. The U.S. monetary base has absolutely exploded over the last couple of years, and all that money is starting to filter through into the hands of consumers. Commodity prices are absolutely skyrocketing, and it is inevitable that those price increases will show up in our stores at some point soon. The U.S. dollar has already been slipping substantially, and now there is every indication that the Fed is hungry to start printing even more money. All of these things are going to cause a rise in inflation. Not that we aren't already seeing inflation in many sectors of the economy. Airline fares for the holiday season are up 20 to 30 percent above last year's rates. Double-digit increases in health insurance premiums are being reported from coast to coast. The price of food has been quietly sneaking up even at places like Wal-Mart. Meanwhile the U.S. government insists that the rate of inflation is close to zero. Anyone who actually believes the government inflation numbers is living in a fantasy world. The U.S. government has been openly manipulating official inflation numbers for several decades now.

But we really haven't seen anything yet. As increasingly larger amounts of paper money are dumped into the economy, we are eventually going to see the worst inflation in American history. The only real question is how far down the road are we going to get before it happens.

Take a few moments and digest the chart below. It shows just how dramatically the U.S. monetary base has been expanded recently....

Up to this point this dramatic expansion of the U.S. monetary base has not caused that much inflation because U.S. government borrowing has soaked most of it up and U.S. banks have been hoarding cash and have been building up their reserves.

However, this situation will not last forever. Eventually all this cash will make its way through the food chain and into the hands of U.S. consumers.

But what is even more troubling is the dramatic spike in commodity prices that we have seen in 2010.

Wheat futures have surged 63 percent since the month of June. Wheat has recently been selling well above 7 dollars a bushel on the Chicago Board of Trade.

But wheat is far from alone. In his recent column entitled "An Inflationary Cocktail In The Making", Richard Benson listed many of the other commodities that have seen extraordinary price increases over the past year....

*Agricultural Raw Materials: 24%

*Industrial Inputs Index: 25%

*Metals Price Index: 26%

*Coffee: 45%

*Barley: 32%

*Oranges: 35%

*Beef: 23%

*Pork: 68%

*Salmon: 30%

*Sugar: 24%

*Wool: 20%

*Cotton: 40%

*Palm Oil: 26%

*Hides: 25%

*Rubber: 62%

*Iron Ore: 103%

Now, as those price increases enter the chain of production do you think that there is any chance that they will not cause inflation?

Do you think there is any chance at all that producers and retailers will not pass those costs on to consumers?

It is time to face facts.

Those cost increases are going to filter all the way through the system and your paycheck is soon not going to stretch nearly as far.

Inflation is coming.

Many savvy investors understand what is going on right now. That is one reason why gold and silver are absolutely soaring at the moment.

The price of gold set another record high on Friday for the sixth straight day.

Silver has also experienced extraordinary gains recently, and the U.S. Mint has officially raised their wholesale pricing above spot on American Silver Eagles from $1.50 to $2.00.

Meanwhile, there are even more rumblings that the Fed wants to print lots more money. On Friday, the president of the Federal Reserve Bank of New York, William Dudley, stated that the high unemployment and the low inflation that the United States is experiencing right now are "wholly unacceptable"....

"Further action is likely to be warranted unless the economic outlook evolves in such a way that makes me more confident that we will see better outcomes for both employment and inflation before long."

During his remarks, Dudley even mentioned what the effect of another $500 billion increase in the Fed?s balance sheet would be.

Now keep in mind, this is not just another "Joe" who is making these remarks.

This is the president of the Federal Reserve Bank of New York - the most important of all the regional Fed banks.

In recent weeks it is almost as if you can hear Fed officials salivate as they consider the prospect of flooding the economy with even more money.

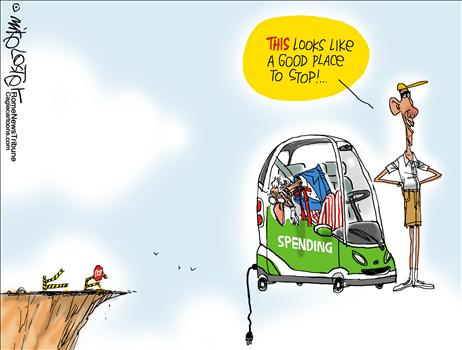

Up to this point, very little has worked to stimulate the dying U.S. economy. The Federal Reserve and the Obama administration are getting nervous as the American people become increasingly frustrated about the economic situation.

So will flooding the economy with even more money and causing even more inflation do the trick?

Well, no, but what inflated GDP figures will do is enable Obama and the Fed to say: "Look the economy is growing again!"

But if a flood of paper money causes the value of goods and services produced in the U.S. to go up by 5 percent but the real inflation rate is 10 percent, are we better off or are we worse off?

It doesn't take a genius to figure that one out.

So don't get fooled by "economic growth" numbers. Just because more money is changing hands doesn't mean that the U.S. economy is doing better.

In fact, many American families are going to be financially shredded by the coming inflation tsunami.

Just think about it.

How far will your paycheck go when a half gallon of milk is 10 dollars and a loaf of bread is 5 dollars?

Already, it is incredibly difficult for the average American family of four to get by on $50,000 a year.

So how much money will we need when rampant inflation starts kicking in?

And do you think that your employers will actually give you pay raises to keep up with all of this inflation?

Not in these economic conditions.

In fact, median household incomes are declining from coast to coast all over the United States.

Earlier this year, Ben Bernanke promised Congress that the Federal Reserve would not "print money" to help the U.S. Congress finance the exploding U.S. national debt.

Did any of you believe him at the time?

Did any of you actually believe that the Federal Reserve would act responsibly and would attempt to keep the money supply and inflation under control?

The reality is that the entire Federal Reserve system is predicated on perpetual inflation and a perpetually expanding national debt.

Whatever wealth you and your family have been able to scrape together is going to continue to be whittled away month after month after month by the hidden tax of inflation.

And unfortunately, as discussed above, inflation is about to get a whole lot worse.

So is there any room for optimism? Is there any hope that we will not see horrible inflation in the years ahead? Please feel free to leave a comment with your opinion below....

Rampant Inflation In 2011? The Monetary Base Is Exploding, Commodity Prices Are Skyrocketing And The Fed Wants To Print Lots More Money

Are you ready for rampant inflation? Well, unfortunately it looks like it might be headed our way. The U.S. monetary base has absolutely exploded over the last couple of years, and all that money is starting to filter through into the hands of consumers. Commodity prices are absolutely skyrocketing, and it is inevitable that those price increases will show up in our stores at some point soon. The U.S. dollar has already been slipping substantially, and now there is every indication that the Fed is hungry to start printing even more money. All of these things are going to cause a rise in inflation. Not that we aren't already seeing inflation in many sectors of the economy. Airline fares for the holiday season are up 20 to 30 percent above last year's rates. Double-digit increases in health insurance premiums are being reported from coast to coast. The price of food has been quietly sneaking up even at places like Wal-Mart. Meanwhile the U.S. government insists that the rate of inflation is close to zero. Anyone who actually believes the government inflation numbers is living in a fantasy world. The U.S. government has been openly manipulating official inflation numbers for several decades now.

But we really haven't seen anything yet. As increasingly larger amounts of paper money are dumped into the economy, we are eventually going to see the worst inflation in American history. The only real question is how far down the road are we going to get before it happens.

Take a few moments and digest the chart below. It shows just how dramatically the U.S. monetary base has been expanded recently....

Up to this point this dramatic expansion of the U.S. monetary base has not caused that much inflation because U.S. government borrowing has soaked most of it up and U.S. banks have been hoarding cash and have been building up their reserves.

However, this situation will not last forever. Eventually all this cash will make its way through the food chain and into the hands of U.S. consumers.

But what is even more troubling is the dramatic spike in commodity prices that we have seen in 2010.

Wheat futures have surged 63 percent since the month of June. Wheat has recently been selling well above 7 dollars a bushel on the Chicago Board of Trade.

But wheat is far from alone. In his recent column entitled "An Inflationary Cocktail In The Making", Richard Benson listed many of the other commodities that have seen extraordinary price increases over the past year....

*Agricultural Raw Materials: 24%

*Industrial Inputs Index: 25%

*Metals Price Index: 26%

*Coffee: 45%

*Barley: 32%

*Oranges: 35%

*Beef: 23%

*Pork: 68%

*Salmon: 30%

*Sugar: 24%

*Wool: 20%

*Cotton: 40%

*Palm Oil: 26%

*Hides: 25%

*Rubber: 62%

*Iron Ore: 103%

Now, as those price increases enter the chain of production do you think that there is any chance that they will not cause inflation?

Do you think there is any chance at all that producers and retailers will not pass those costs on to consumers?

It is time to face facts.

Those cost increases are going to filter all the way through the system and your paycheck is soon not going to stretch nearly as far.

Inflation is coming.

Many savvy investors understand what is going on right now. That is one reason why gold and silver are absolutely soaring at the moment.

The price of gold set another record high on Friday for the sixth straight day.

Silver has also experienced extraordinary gains recently, and the U.S. Mint has officially raised their wholesale pricing above spot on American Silver Eagles from $1.50 to $2.00.

Meanwhile, there are even more rumblings that the Fed wants to print lots more money. On Friday, the president of the Federal Reserve Bank of New York, William Dudley, stated that the high unemployment and the low inflation that the United States is experiencing right now are "wholly unacceptable"....

"Further action is likely to be warranted unless the economic outlook evolves in such a way that makes me more confident that we will see better outcomes for both employment and inflation before long."

During his remarks, Dudley even mentioned what the effect of another $500 billion increase in the Fed?s balance sheet would be.

Now keep in mind, this is not just another "Joe" who is making these remarks.

This is the president of the Federal Reserve Bank of New York - the most important of all the regional Fed banks.

In recent weeks it is almost as if you can hear Fed officials salivate as they consider the prospect of flooding the economy with even more money.

Up to this point, very little has worked to stimulate the dying U.S. economy. The Federal Reserve and the Obama administration are getting nervous as the American people become increasingly frustrated about the economic situation.

So will flooding the economy with even more money and causing even more inflation do the trick?

Well, no, but what inflated GDP figures will do is enable Obama and the Fed to say: "Look the economy is growing again!"

But if a flood of paper money causes the value of goods and services produced in the U.S. to go up by 5 percent but the real inflation rate is 10 percent, are we better off or are we worse off?

It doesn't take a genius to figure that one out.

So don't get fooled by "economic growth" numbers. Just because more money is changing hands doesn't mean that the U.S. economy is doing better.

In fact, many American families are going to be financially shredded by the coming inflation tsunami.

Just think about it.

How far will your paycheck go when a half gallon of milk is 10 dollars and a loaf of bread is 5 dollars?

Already, it is incredibly difficult for the average American family of four to get by on $50,000 a year.

So how much money will we need when rampant inflation starts kicking in?

And do you think that your employers will actually give you pay raises to keep up with all of this inflation?

Not in these economic conditions.

In fact, median household incomes are declining from coast to coast all over the United States.

Earlier this year, Ben Bernanke promised Congress that the Federal Reserve would not "print money" to help the U.S. Congress finance the exploding U.S. national debt.

Did any of you believe him at the time?

Did any of you actually believe that the Federal Reserve would act responsibly and would attempt to keep the money supply and inflation under control?

The reality is that the entire Federal Reserve system is predicated on perpetual inflation and a perpetually expanding national debt.

Whatever wealth you and your family have been able to scrape together is going to continue to be whittled away month after month after month by the hidden tax of inflation.

And unfortunately, as discussed above, inflation is about to get a whole lot worse.

So is there any room for optimism? Is there any hope that we will not see horrible inflation in the years ahead? Please feel free to leave a comment with your opinion below....