Dems Threaten Congressional Show Trials After US Companies Leak Real Economic Damage of Obamacare

Sunday, March 28, 2010, 8:55 AM

Jim Hoft

Late last week several US corporations leaked how the democrat’s health care bill will kill their businesses. The radicals in Congress were not pleased that these corporations would go public with this devastating information. In response, democrats threatened to call for Congressional show trials to publicly humiliate these corporations.

The Wall Street Journal reported:

The last paragraph says it all about the democrat’s trickery:

Byron York at The Washington Examiner has more on the show trials.

These democrats in Washington are nothing but thugs. They’ll try anything to keep the truth from coming out about their disastrous legislation.

Sunday, March 28, 2010, 8:55 AM

Jim Hoft

Late last week several US corporations leaked how the democrat’s health care bill will kill their businesses. The radicals in Congress were not pleased that these corporations would go public with this devastating information. In response, democrats threatened to call for Congressional show trials to publicly humiliate these corporations.

The Wall Street Journal reported:

It’s been a banner week for Democrats: ObamaCare passed Congress in its final form on Thursday night, and the returns are already rolling in. Yesterday AT&T announced that it will be forced to make a $1 billion writedown due solely to the health bill, in what has become a wave of such corporate losses.

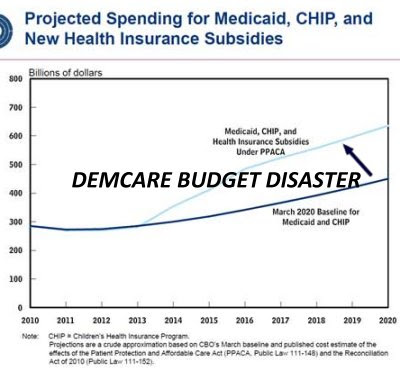

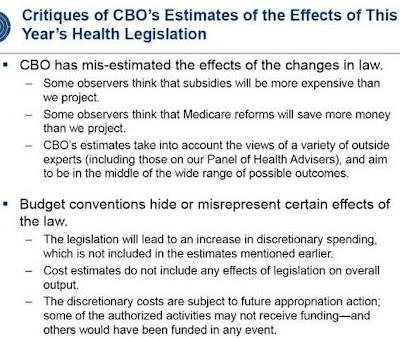

This wholesale destruction of wealth and capital came with more than ample warning. Turning over every couch cushion to make their new entitlement look affordable under Beltway accounting rules, Democrats decided to raise taxes on companies that do the public service of offering prescription drug benefits to their retirees instead of dumping them into Medicare. We and others warned this would lead to AT&T-like results, but like so many other ObamaCare objections Democrats waved them off as self-serving or “political.”

…Henry Waxman and House Democrats announced yesterday that they will haul these companies in for an April 21 hearing because their judgment “appears to conflict with independent analyses, which show that the new law will expand coverage and bring down costs.”

In other words, shoot the messenger. Black-letter financial accounting rules require that corporations immediately restate their earnings to reflect the present value of their long-term health liabilities, including a higher tax burden. Should these companies have played chicken with the Securities and Exchange Commission to avoid this politically inconvenient reality? Democrats don’t like what their bill is doing in the real world, so they now want to intimidate CEOs into keeping quiet.

On top of AT&T’s $1 billion, the writedown wave so far includes Deere & Co., $150 million; Caterpillar, $100 million; AK Steel, $31 million; 3M, $90 million; and Valero Energy, up to $20 million. Verizon has also warned its employees about its new higher health-care costs, and there will be many more in the coming days and weeks.

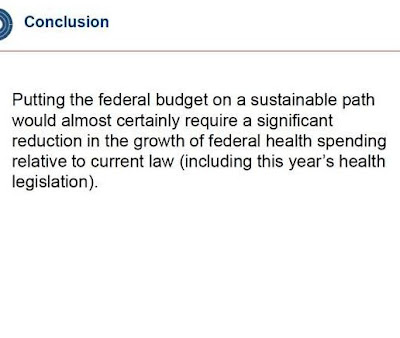

The Democratic political calculation with ObamaCare is the proverbial boiling frog: Gradually introduce a health-care entitlement by hiding the true costs, hook the middle class on new subsidies until they become unrepealable, but try to delay the adverse consequences and major new tax hikes so voters don’t make the connection between their policy and the economic wreckage. But their bill was such a shoddy, jerry-rigged piece of work that the damage is coming sooner than even some critics expected.

Waxman is also demanding that the executives give lawmakers internal company documents related to health care finances — a move one committee Republicans describes as “an attempt to intimidate and silence opponents of the Democrats’ flawed health care reform legislation.”

…Waxman has ordered the executives to explain themselves at an April 21 hearing before the Energy and Commerce Committee’s investigative subcommittee. That subcommittee just happens to be chaired by Rep. Bart Stupak, the Michigan Democrat who held out his vote on health care reform until a few hours before final passage on March 21, giving the bill’s opponents the unfounded hope that he might vote against it.

Waxman’s demands came Friday in letters to several executives. “After the president signed the health care reform bill into law, your company announced that provisions in the law could adversely affect your ability to provide health insurance,” Waxman wrote to Randall Stephenson, chairman and CEO of AT&T. A few hours before Waxman sent his letter, AT&T announced it will take a $1 billion charge against earnings because of the tax provision in the new health bill. AT&T also said it will be “evaluating prospective changes” to its health care benefits for all workers…

Waxman’s request could prove particularly troubling for the companies. The executives will undoubtedly view such documents as confidential, but if they fail to give Waxman everything he wants, they run the risk of subpoenas and threats from the chairman. And all as punishment for making a business decision in light of a new tax situation.