Bleak outlook

Sands Chief Operating Officer Rob Goldstein told analysts on a conference call with investors Wednesday that the outlook for the company’s venerable meetings and conventions business is bleak for the rest of the year.

“Of all (our markets, Las Vegas, Macao and Singapore), I view Las Vegas least favorably,” Goldstein said. “Las Vegas, especially our company but really the whole city, is dependent on group, convention and banquet segments’ return. I see nothing that indicates that 2020 will return at all.”

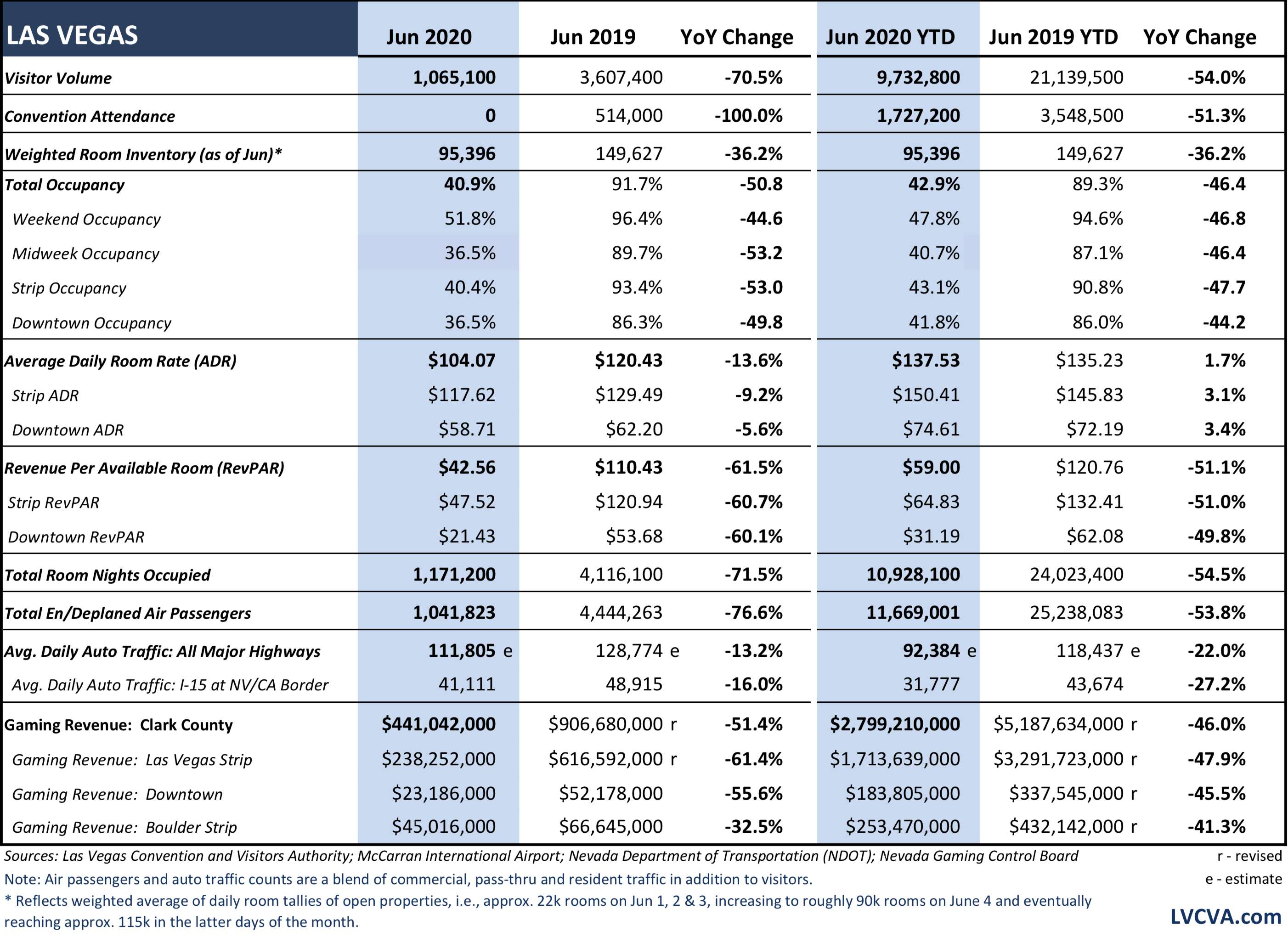

The company is dependent on conventions driving food and beverage, hotel rooms, entertainment and casino revenue. A glimpse at those quarterly figures tells the story: Hotel room revenue fell 94.2 percent to $9 million.

Occupancy rates decreased 63.7 percentage points to 33.5 percent. The average daily room rate fell 35.5 percent to $162. Slot win declined 81.7 percent to $11 million and the table games drop decreased 80.7 percent to $99 million, while win percentage decreased 6 points to 11.8 percent.

“Las Vegas cannot perform without the return of these segments,” Goldstein said. “It cannot make money with negligible occupancy midweek, maybe 50 percent capacity on the weekend. In essence, we’re running a regional casino predicated on drive-in business.”

Of the three markets Sands is in, Las Vegas is the one most dependent on fly-in traffic. Goldstein said only about 10 percent of the Macao market flies to airports in Macao or Hong Kong. In Las Vegas, about 45 percent of the market is dependent on people traveling on planes. And right now, the virus is keeping passengers off them in droves.

“We have airlift somewhere around 40 percent of what it was,” Goldstein said. “Of that 40 percent, the occupancy of those planes is much less than what it was previously. We’re in a world of hurt here in terms of Vegas. As far as looking ahead, I don’t crystal ball (any changes until) ‘21.”