Keynesian Economics Is A Failure

Keynesian exuberance for the powers of stimulating demand or the 'consumer' has been in vogue since the 1930s. It is sheer nonsense which is taught in every school across the globe. Keynesian economics is little more than intellectual pablum used by those in power or by a technocratic and largely illiterate elite to increase their power; enhance government; print money and otherwise destroy normal economic relationships. Keynes' theory, so believed by professors is in practice a disaster.

Keynes was a left wing wall flower and a member of the deranged Bloomsbury group of inter-World War British pacifists. He was an arrogant theorist who truly believed in the magical elixir of large government and in the technocratic dream of controlling billions of personal, business and economic decisions, to programmatically construct a perfect world order. Keynes gave intellect and jargon filled cover and rationale to politicians and demagogues who would cite his book, 'The General Theory of Employment, Interest and Money', to justify state interventionism.

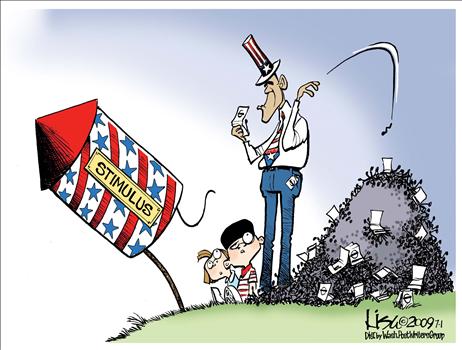

According to this theory which has failed in practice every time it has been tried, governments can stimulate an economy through granting consumers, workers and businesses sums of borrowed money. This is termed a 'stimulus'. This debt or current deficit financing stimulus, is then paid back or retired, when the economy strengthened by consumer spending and business investment, produces a surplus of tax revenues. The stimulus is needed, so argued Keynes, to overcome business cycles, downturns and unexpected events which would decrease jobs, increase unemployment and impact state revenues. By macro and micro-managing economic and production processes, the state, so thought Keynes, would avoid cyclical variations and ensure that the lowest level of unemployment could be maintained. Government power was thus indispensable to full employment and income equality.

There are many problems with such a counter-rational plan to economic management. None of Keynes' core assumptions make sense when they are analysed either separately or together. Business cycles have historically been caused by governments, and they are usually a response to government policies to increase the size of the state through trade barriers, higher taxation, more spending, more regulation and programs of fear and compliance. The Great Depression, the 70s Stagflation and the current financial crisis are all obvious examples of this fact.

Government causing economic malaise would appear to mean that government programs are not the solutions required to either get out of an economic downturn, nor to prevent future derailments from taking place.

The main impact of Keynesian economic stimuli is to increase debt; raise future tax rates and distort the normal functionings of economic markets and personal and corporate decision making. Governments choose winners and confirm losers. The winners will include companies which get bailed out, those receiving welfare, unions and others having their jobs protected, those receiving redistributed incomes and those paid off for political support. The losers invariably include firms both domestic and international who want fair and free trade; higher income families; small businesses who are classified under high income categories; future generations who must pay off the debt; and consumers who pay a higher costs for all products and services.

Under Keynesian philosophy, government and technocrats assume the role of God. Given the poverty of God heads throughout history, this is probably not a noble supposition to support.

Brian Reidl from Heritage Institute wrong an excellent article recently on the fallacy that government spending, or what is termed Keynesian deficit spending, run by God-heads, is beneficial (see Reidl

http://www.frontpagemag.com/Articles/authors.aspx?GUID=220a4261-b3c8-4338-a5be-62bcc3f3b8d3). In this article he makes the following important points about demand-side management and the Keynesian fetish for economic control.

?Government cannot create new purchasing power out of thin air. If Congress funds new spending with taxes, it is simply redistributing existing income. If Congress instead borrows the money from domestic investors, those investors will have that much less to invest or to spend in the private economy. If Congress borrows the money from foreigners, the balance of payments will adjust by equally reducing net exports, leaving GDP unchanged. Every dollar Congress spends must first come from somewhere else.

This does not mean that government spending has no economic impact at all. Government spending often alters the consumption of total demand, such as increasing consumption at the expense of investment.?

When stimulus packages are created the money has to come from someone via taxes, or be printed. Both are net negatives to the economy. Economic growth only results from producing more goods and services (not from redistributing existing income), and that requires productivity growth and growth in the labor supply as productivity not only increases wealth but also wages and wage opportunities.

Historically of course government spending has reduced productivity and long-term economic growth due to some obvious reasons. As government spends more it raises taxes which reduces profits, productivity and wage and job creation. As government incurs more debt through stimulus and demand side packages it reduces the incentive to produce and displaces money by removing the more productive private sector from the economic equation and replacing it with a far less effective state dollar, taxed or printed on government printing press. The inefficiency of government policy in health, housing, education, and general industry are obvious creating huge costs which must be borne by ordinary taxpayers ? ineffective solutions at a higher price one can say.

And as Reidl sources and proves:

?Mountains of academic studies show how government expansions reduce economic growth:

1.Public Finance Review reported that "higher total government expenditure, no matter how financed, is associated with a lower growth rate of real per capita gross state product."

2.The Quarterly Journal of Economics reported that "the ratio of real government consumption expenditure to real GDP had a negative association with growth and investment," and "growth is inversely related to the share of government consumption in GDP, but insignificantly related to the share of public investment."

3.A Journal of Macroeconomics study discovered that "the coefficient of the additive terms of the government-size variable indicates that a 1% increase in government size decreases the rate of economic growth by 0.143%."

4.Public Choice reported that "a one percent increase in government spending as a percent of GDP (from, say, 30 to 31%) would raise the unemployment rate by approximately .36 of one percent (from, say, 8 to 8.36 percent)."

It is obvious that Keynesian economics and demand management are tools for fools. Wealth, a better society, a cleaner world, a higher level of development is not coerced by government. It only occurs when free people operating in free markets are allowed to interact and determine the price and supply of various goods and services. Government involvement ensures the opposite and is a theory mired in cultish theological absurdity.

By: C. Read

Article Directory: Article Dashboard Directory | Submit Articles | Search Find Free Content | Author Submission

Learn more about why Keynesian economics won?t work and free markets is the answer at Craig Read.

Keynesian exuberance for the powers of stimulating demand or the 'consumer' has been in vogue since the 1930s. It is sheer nonsense which is taught in every school across the globe. Keynesian economics is little more than intellectual pablum used by those in power or by a technocratic and largely illiterate elite to increase their power; enhance government; print money and otherwise destroy normal economic relationships. Keynes' theory, so believed by professors is in practice a disaster.

Keynes was a left wing wall flower and a member of the deranged Bloomsbury group of inter-World War British pacifists. He was an arrogant theorist who truly believed in the magical elixir of large government and in the technocratic dream of controlling billions of personal, business and economic decisions, to programmatically construct a perfect world order. Keynes gave intellect and jargon filled cover and rationale to politicians and demagogues who would cite his book, 'The General Theory of Employment, Interest and Money', to justify state interventionism.

According to this theory which has failed in practice every time it has been tried, governments can stimulate an economy through granting consumers, workers and businesses sums of borrowed money. This is termed a 'stimulus'. This debt or current deficit financing stimulus, is then paid back or retired, when the economy strengthened by consumer spending and business investment, produces a surplus of tax revenues. The stimulus is needed, so argued Keynes, to overcome business cycles, downturns and unexpected events which would decrease jobs, increase unemployment and impact state revenues. By macro and micro-managing economic and production processes, the state, so thought Keynes, would avoid cyclical variations and ensure that the lowest level of unemployment could be maintained. Government power was thus indispensable to full employment and income equality.

There are many problems with such a counter-rational plan to economic management. None of Keynes' core assumptions make sense when they are analysed either separately or together. Business cycles have historically been caused by governments, and they are usually a response to government policies to increase the size of the state through trade barriers, higher taxation, more spending, more regulation and programs of fear and compliance. The Great Depression, the 70s Stagflation and the current financial crisis are all obvious examples of this fact.

Government causing economic malaise would appear to mean that government programs are not the solutions required to either get out of an economic downturn, nor to prevent future derailments from taking place.

The main impact of Keynesian economic stimuli is to increase debt; raise future tax rates and distort the normal functionings of economic markets and personal and corporate decision making. Governments choose winners and confirm losers. The winners will include companies which get bailed out, those receiving welfare, unions and others having their jobs protected, those receiving redistributed incomes and those paid off for political support. The losers invariably include firms both domestic and international who want fair and free trade; higher income families; small businesses who are classified under high income categories; future generations who must pay off the debt; and consumers who pay a higher costs for all products and services.

Under Keynesian philosophy, government and technocrats assume the role of God. Given the poverty of God heads throughout history, this is probably not a noble supposition to support.

Brian Reidl from Heritage Institute wrong an excellent article recently on the fallacy that government spending, or what is termed Keynesian deficit spending, run by God-heads, is beneficial (see Reidl

http://www.frontpagemag.com/Articles/authors.aspx?GUID=220a4261-b3c8-4338-a5be-62bcc3f3b8d3). In this article he makes the following important points about demand-side management and the Keynesian fetish for economic control.

?Government cannot create new purchasing power out of thin air. If Congress funds new spending with taxes, it is simply redistributing existing income. If Congress instead borrows the money from domestic investors, those investors will have that much less to invest or to spend in the private economy. If Congress borrows the money from foreigners, the balance of payments will adjust by equally reducing net exports, leaving GDP unchanged. Every dollar Congress spends must first come from somewhere else.

This does not mean that government spending has no economic impact at all. Government spending often alters the consumption of total demand, such as increasing consumption at the expense of investment.?

When stimulus packages are created the money has to come from someone via taxes, or be printed. Both are net negatives to the economy. Economic growth only results from producing more goods and services (not from redistributing existing income), and that requires productivity growth and growth in the labor supply as productivity not only increases wealth but also wages and wage opportunities.

Historically of course government spending has reduced productivity and long-term economic growth due to some obvious reasons. As government spends more it raises taxes which reduces profits, productivity and wage and job creation. As government incurs more debt through stimulus and demand side packages it reduces the incentive to produce and displaces money by removing the more productive private sector from the economic equation and replacing it with a far less effective state dollar, taxed or printed on government printing press. The inefficiency of government policy in health, housing, education, and general industry are obvious creating huge costs which must be borne by ordinary taxpayers ? ineffective solutions at a higher price one can say.

And as Reidl sources and proves:

?Mountains of academic studies show how government expansions reduce economic growth:

1.Public Finance Review reported that "higher total government expenditure, no matter how financed, is associated with a lower growth rate of real per capita gross state product."

2.The Quarterly Journal of Economics reported that "the ratio of real government consumption expenditure to real GDP had a negative association with growth and investment," and "growth is inversely related to the share of government consumption in GDP, but insignificantly related to the share of public investment."

3.A Journal of Macroeconomics study discovered that "the coefficient of the additive terms of the government-size variable indicates that a 1% increase in government size decreases the rate of economic growth by 0.143%."

4.Public Choice reported that "a one percent increase in government spending as a percent of GDP (from, say, 30 to 31%) would raise the unemployment rate by approximately .36 of one percent (from, say, 8 to 8.36 percent)."

It is obvious that Keynesian economics and demand management are tools for fools. Wealth, a better society, a cleaner world, a higher level of development is not coerced by government. It only occurs when free people operating in free markets are allowed to interact and determine the price and supply of various goods and services. Government involvement ensures the opposite and is a theory mired in cultish theological absurdity.

By: C. Read

Article Directory: Article Dashboard Directory | Submit Articles | Search Find Free Content | Author Submission

Learn more about why Keynesian economics won?t work and free markets is the answer at Craig Read.

[/SIZE][/FONT]

[/SIZE][/FONT]