Re: The Barry-Barney Dow is heading for 5000

March 24, 2010

<TABLE width="95%" border=0><TBODY><TR><TD align=left width="80%">

Bull Market or Just Bull?

By John Browne

</TD><TD align=right></TD></TR></TBODY></TABLE>

Last week, the Dow closed at 10,741, up some 64 percent since its 2009 lows,

[03/19/10, Yahoo! Finance] when most markets had priced in the likelihood of financial Armageddon. As the markets have rebounded from the brink of disaster, many Wall Street cheerleaders have proclaimed the dawning of a major new bull market. If we measure market cycles biannually, and if bull markets need not eclipse peaks achieved in previous cycles, then this forecast is spot on. Of course, most investors are not saving for next week, but for homes, college tuitions, and retirements. For these longer term investors, the euphoria of the current rally may soon turn to despair when the market faces the unsavory fundamentals of a second financial crisis.

We have long raised the point that, in general, the political, economic, and financial fundamentals of our new mega-government era do not support a sunny long-term outlook for U.S. stocks. Today, the S&P 500 trades at 21.6 times current earnings, which is 32% higher than the average over the last 30 years.

[03/24/10, multipl.com] With so much economic uncertainty on the horizon, I'm not sure how you make the case that the market is still undervalued. The nature of the recent stock price move appears to be that of a bear-market rally, not a bull-market resurgence.

Politically, this past Sunday's passage of mandatory health insurance for all U.S. citizens, popularly dubbed 'Obamacare,' causes the greatest worry. None of the fundamental problems confronting the American healthcare sector were adequately addressed by this reform. Instead, government controls were increased and entrenched, and expensive new entitlements were offered to the voting public. Far from cutting the deficit, the costs of the new plan are likely to deepen deficits indefinitely. The

Wall Street Journal reported Monday that the cost would be $940 billion over the next decade. The President, in speaking of the new health measure, declared that ?[t]his is only a first step.? As in most socialist regimes, grand promises of milk and honey first win the popular vote, leading to bureaucracies that diminish, if not eradicate, individual freedom of choice.

The American free-enterprise model has been used by myriad nations as an ideal for economic growth and prosperity. As a reward, the United States served for many years as the darling of international investors. On the other hand, socialism has failed everywhere it has been tried.

An America rapidly devolving toward socialism will unquestionably act as a disincentive to international investors. Increasingly, foreign funds will be withdrawn from our shores and taken to parts of the world that embrace capitalism.

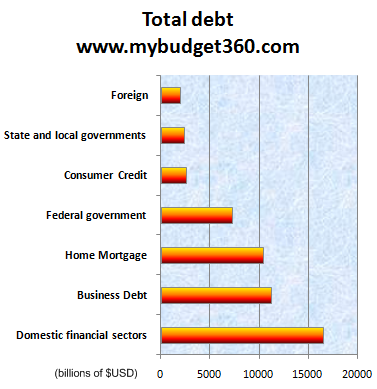

Economically, the United States and European Union, and many of their constituent states, are among the world?s most flagrant debtors. These debts are not being used to invest in profitable endeavors, but rather in welfare hand-outs and make-work projects.

Worse still, these governments are adding new debt with such speed and volume that Moody's has begun to issue warnings on their previously untouchable credit ratings. Besides introducing tremendous regime uncertainty into the markets, spendthrift fiscal policy has the added harm of crowding out corporate and private borrowers.

The private sector can ill-afford this deprivation. While corporate earnings have risen substantially since the country began careening toward recession, this has largely been achieved by layoffs, improvements in inventory controls, and consolidated product lines. With top-line sales decreasing, the ability to produce rising profits by slashing costs cannot continue for long. We're looking for another wave of corporate bankruptcies as the anticipated V-shaped recovery fails to materialize.

The technical situation of the U.S. stock market looks similarly fragile. The 64 percent rally from the lows of early 2009 appears overbought. The fact that it has occurred on very light volume makes today's prices even more tenuous. That the rally may continue of its own momentum through the spring does not alter the poor fundamentals.

While stocks continued to move upward last week, the market is sensitive to Greece, Portugal and Europe's debt problems, as well as political and economic problems at home. There is some job recovery, but far too little. Corporations and governments are depending on a miraculous economic boom to remain solvent.

When the Fed finally allows interest rates to reach more appropriate levels, look for the glass floor to begin cracking. It is comforting to think bullish, but, for now, the aura of recovery is just so much bull.

As an aside, all investors should keep in mind 'opportunity costs' as a matter of regular portfolio review. Although domestic stocks appear to have put in a rock solid performance over the past 12 months, one must weigh the outcome against asset classes around the world.

Many may assume that the gains are unique to America when, in fact, other markets may have had largely better performance. Investors should bear in mind this opportunity cost to ensure they do not remain exclusively in the U.S. at the cost of perhaps missing investments found in China, India, Canada, Australia, and other attractive markets.

http://www.europac.net/#

</TD></TR></TBODY></TABLE>[FONT=Verdana, Arial, Helvetica, sans-serif]

</TD></TR></TBODY></TABLE>[FONT=Verdana, Arial, Helvetica, sans-serif].png)

</TD></TR></TBODY></TABLE>

</TD></TR></TBODY></TABLE>